Featured

Liquidity

How to Access Liquidity Without Selling Your Investments

Learn what a securities-backed loan (SBL/SBLOC) is, how borrowing against a portfolio works, allowed use cases, key considerations, and when you should consider a SBL over selling stock.

Joseph Wang

Feb 10, 2026

Featured

Case Study

SyntheticFi Powers Home Purchases for Oui Financial Clients

Oui Financial bypasses the rigid underwriting, slow process, and high costs of traditional lenders with SyntheticFi to offer their clients a streamlined, cost-effective alternative.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

Liquidity

Tax

Mortgage

Refinancing using SyntheticFi

See how you can leverage SyntheticFi's various lending options to refinance various existing loans, from HELOC to vehicle loans.

Joseph Wang

Apr 29, 2025

Featured

Liquidity

Mortgage

Bridge Financing with SyntheticFi

Learn about how SyntheticFi is a great option for bridging funding gaps for various scenarios from property buying to fulfilling unexpected expenses.

Joseph Wang

Apr 29, 2025

Featured

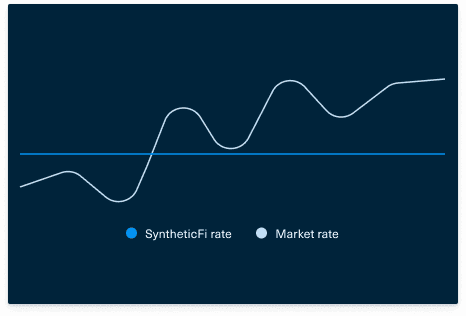

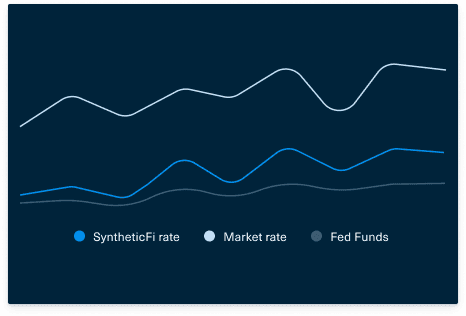

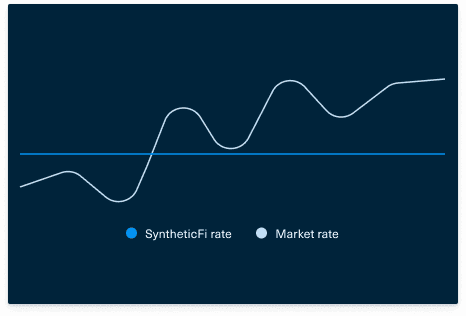

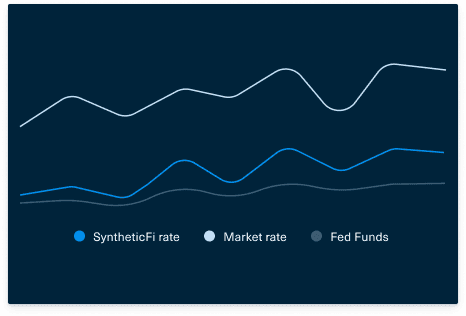

Box Spread Basics

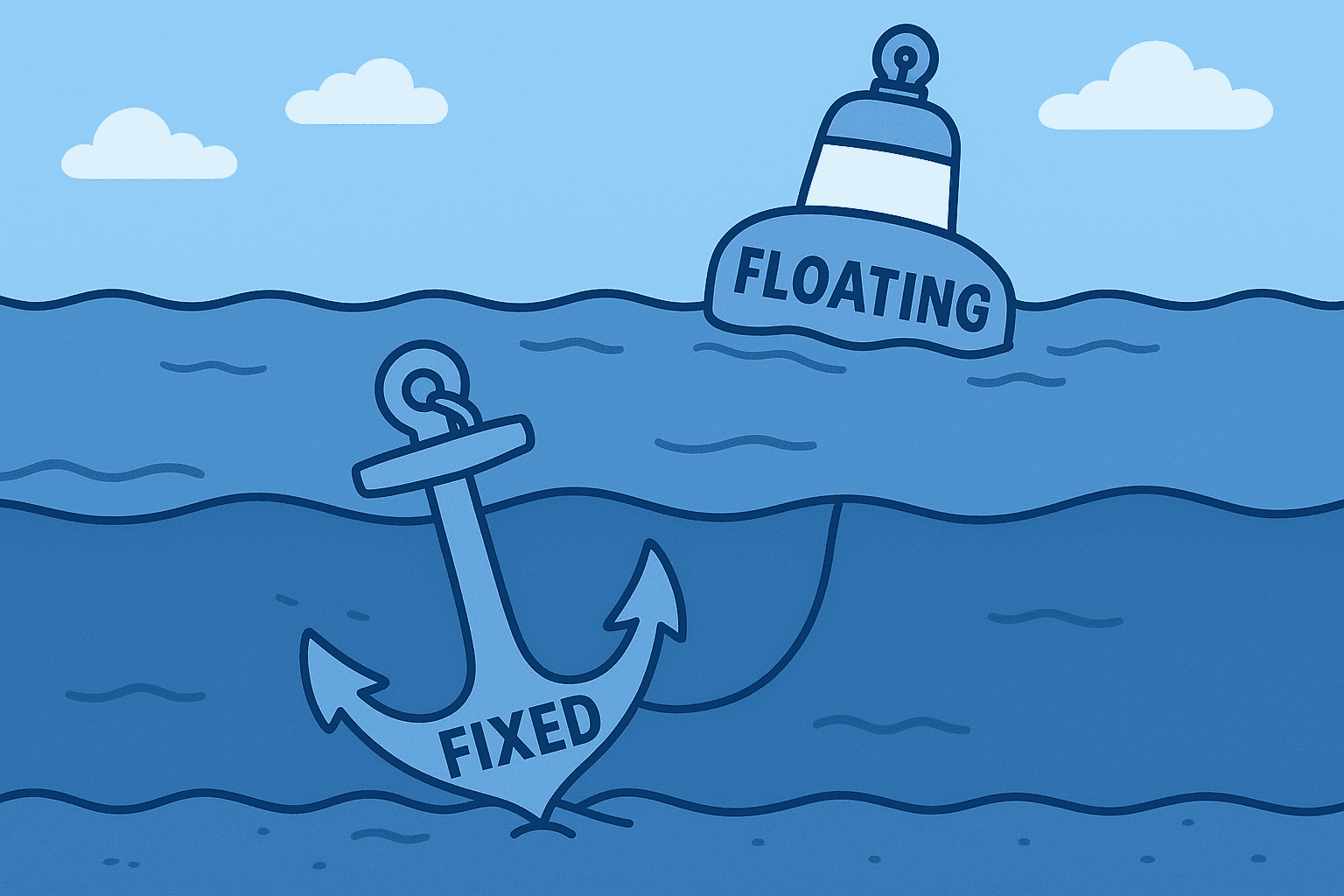

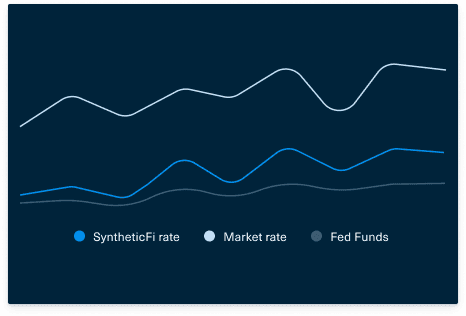

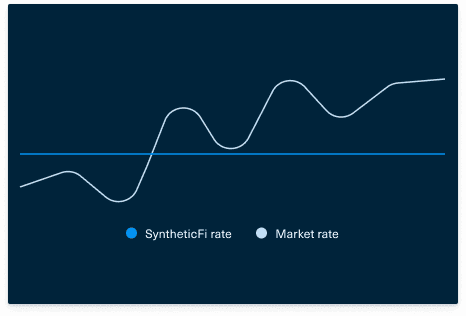

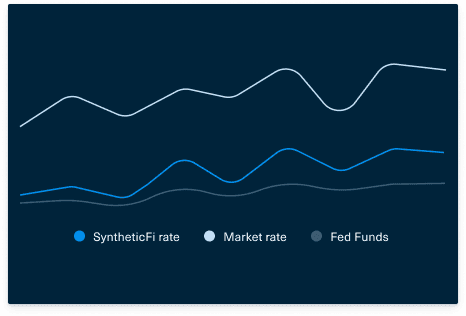

How to Choose Between Floating and Fixed Interest Rates

Understanding when its best to select floating or fixed interest rates for your clients needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

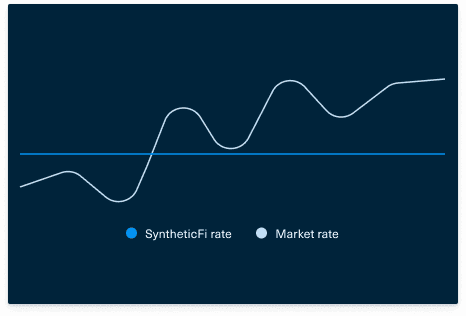

Fixed Rates

Explaining SyntheticFi's fixed-rate loans, and how they're a great financing option for long-term or predictable needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Floating Rates

Explaining SyntheticFi's floating-rate loans, and how they're a flexible financing option for short-term or variable needs.

Joseph Wang

Apr 29, 2025

Liquidity

Tax

Mortgage

How Debt Can Preserve and Grow Wealth

A primer on how to strategically buy assets like stock & real estate, and borrow against them at low-interest rates, to preserve and build your wealth.

Joseph Wang

Apr 28, 2025

Featured

Case Study

SyntheticFi Supports International Clients When Banks Are Unwilling to Lend

Divergent Capital Asset Management is able to provide securities-backed lending to international clients with SyntheticFi, at lower interest rates.

Joseph Wang

Apr 28, 2025

Tax

Box Spread Basics

Tax Deductibility of Box Spreads

Breaking down the tax deductions for interest loan interest from SyntheticFI loans, and how to report them.

Joseph Wang

Apr 24, 2025

Mortgage

Box Spread Basics

Financing a Home with SyntheticFi

A guide for financing real estate purchases with SyntheticFi to keep a client's portfolio assets while enjoying low interest rates and uncapped tax deductibility on interest.

Joseph Wang

Apr 23, 2025

Featured

Mortgage

Box Spreads: A Better Alternative to Mortgages

Traditional mortgages are expensive and require down payments. Learn about how SyntheticFi's box spread lending strategy offers a better alternative.

Joseph Wang

Apr 22, 2025

Featured

Tax

The Tax Benefits of SyntheticFi Securities-Backed Loans

Learn about the tax advantages of SyntheticFi's lending solutions over traditional securities-backed loans, including universal tax deductibility against capital gains.

Joseph Wang

Apr 22, 2025

Featured

Liquidity

How to Access Liquidity Without Selling Your Investments

Learn what a securities-backed loan (SBL/SBLOC) is, how borrowing against a portfolio works, allowed use cases, key considerations, and when you should consider a SBL over selling stock.

Joseph Wang

Feb 10, 2026

Featured

Case Study

SyntheticFi Powers Home Purchases for Oui Financial Clients

Oui Financial bypasses the rigid underwriting, slow process, and high costs of traditional lenders with SyntheticFi to offer their clients a streamlined, cost-effective alternative.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

Liquidity

Tax

Mortgage

Refinancing using SyntheticFi

See how you can leverage SyntheticFi's various lending options to refinance various existing loans, from HELOC to vehicle loans.

Joseph Wang

Apr 29, 2025

Featured

Liquidity

Mortgage

Bridge Financing with SyntheticFi

Learn about how SyntheticFi is a great option for bridging funding gaps for various scenarios from property buying to fulfilling unexpected expenses.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

How to Choose Between Floating and Fixed Interest Rates

Understanding when its best to select floating or fixed interest rates for your clients needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Fixed Rates

Explaining SyntheticFi's fixed-rate loans, and how they're a great financing option for long-term or predictable needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Floating Rates

Explaining SyntheticFi's floating-rate loans, and how they're a flexible financing option for short-term or variable needs.

Joseph Wang

Apr 29, 2025

Liquidity

Tax

Mortgage

How Debt Can Preserve and Grow Wealth

A primer on how to strategically buy assets like stock & real estate, and borrow against them at low-interest rates, to preserve and build your wealth.

Joseph Wang

Apr 28, 2025

Featured

Case Study

SyntheticFi Supports International Clients When Banks Are Unwilling to Lend

Divergent Capital Asset Management is able to provide securities-backed lending to international clients with SyntheticFi, at lower interest rates.

Joseph Wang

Apr 28, 2025

Tax

Box Spread Basics

Tax Deductibility of Box Spreads

Breaking down the tax deductions for interest loan interest from SyntheticFI loans, and how to report them.

Joseph Wang

Apr 24, 2025

Mortgage

Box Spread Basics

Financing a Home with SyntheticFi

A guide for financing real estate purchases with SyntheticFi to keep a client's portfolio assets while enjoying low interest rates and uncapped tax deductibility on interest.

Joseph Wang

Apr 23, 2025

Featured

Mortgage

Box Spreads: A Better Alternative to Mortgages

Traditional mortgages are expensive and require down payments. Learn about how SyntheticFi's box spread lending strategy offers a better alternative.

Joseph Wang

Apr 22, 2025

Featured

Tax

The Tax Benefits of SyntheticFi Securities-Backed Loans

Learn about the tax advantages of SyntheticFi's lending solutions over traditional securities-backed loans, including universal tax deductibility against capital gains.

Joseph Wang

Apr 22, 2025

Featured

Liquidity

How to Access Liquidity Without Selling Your Investments

Learn what a securities-backed loan (SBL/SBLOC) is, how borrowing against a portfolio works, allowed use cases, key considerations, and when you should consider a SBL over selling stock.

Joseph Wang

Feb 10, 2026

Featured

Case Study

SyntheticFi Powers Home Purchases for Oui Financial Clients

Oui Financial bypasses the rigid underwriting, slow process, and high costs of traditional lenders with SyntheticFi to offer their clients a streamlined, cost-effective alternative.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

Liquidity

Tax

Mortgage

Refinancing using SyntheticFi

See how you can leverage SyntheticFi's various lending options to refinance various existing loans, from HELOC to vehicle loans.

Joseph Wang

Apr 29, 2025

Featured

Liquidity

Mortgage

Bridge Financing with SyntheticFi

Learn about how SyntheticFi is a great option for bridging funding gaps for various scenarios from property buying to fulfilling unexpected expenses.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

How to Choose Between Floating and Fixed Interest Rates

Understanding when its best to select floating or fixed interest rates for your clients needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Fixed Rates

Explaining SyntheticFi's fixed-rate loans, and how they're a great financing option for long-term or predictable needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Floating Rates

Explaining SyntheticFi's floating-rate loans, and how they're a flexible financing option for short-term or variable needs.

Joseph Wang

Apr 29, 2025

Liquidity

Tax

Mortgage

How Debt Can Preserve and Grow Wealth

A primer on how to strategically buy assets like stock & real estate, and borrow against them at low-interest rates, to preserve and build your wealth.

Joseph Wang

Apr 28, 2025

Featured

Case Study

SyntheticFi Supports International Clients When Banks Are Unwilling to Lend

Divergent Capital Asset Management is able to provide securities-backed lending to international clients with SyntheticFi, at lower interest rates.

Joseph Wang

Apr 28, 2025

Tax

Box Spread Basics

Tax Deductibility of Box Spreads

Breaking down the tax deductions for interest loan interest from SyntheticFI loans, and how to report them.

Joseph Wang

Apr 24, 2025

Mortgage

Box Spread Basics

Financing a Home with SyntheticFi

A guide for financing real estate purchases with SyntheticFi to keep a client's portfolio assets while enjoying low interest rates and uncapped tax deductibility on interest.

Joseph Wang

Apr 23, 2025

Featured

Mortgage

Box Spreads: A Better Alternative to Mortgages

Traditional mortgages are expensive and require down payments. Learn about how SyntheticFi's box spread lending strategy offers a better alternative.

Joseph Wang

Apr 22, 2025

Featured

Tax

The Tax Benefits of SyntheticFi Securities-Backed Loans

Learn about the tax advantages of SyntheticFi's lending solutions over traditional securities-backed loans, including universal tax deductibility against capital gains.

Joseph Wang

Apr 22, 2025

All

Featured

Liquidity

How to Access Liquidity Without Selling Your Investments

Learn what a securities-backed loan (SBL/SBLOC) is, how borrowing against a portfolio works, allowed use cases, key considerations, and when you should consider a SBL over selling stock.

Joseph Wang

Feb 10, 2026

Featured

Case Study

SyntheticFi Powers Home Purchases for Oui Financial Clients

Oui Financial bypasses the rigid underwriting, slow process, and high costs of traditional lenders with SyntheticFi to offer their clients a streamlined, cost-effective alternative.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

Liquidity

Tax

Mortgage

Refinancing using SyntheticFi

See how you can leverage SyntheticFi's various lending options to refinance various existing loans, from HELOC to vehicle loans.

Joseph Wang

Apr 29, 2025

Featured

Liquidity

Mortgage

Bridge Financing with SyntheticFi

Learn about how SyntheticFi is a great option for bridging funding gaps for various scenarios from property buying to fulfilling unexpected expenses.

Joseph Wang

Apr 29, 2025

Featured

Box Spread Basics

How to Choose Between Floating and Fixed Interest Rates

Understanding when its best to select floating or fixed interest rates for your clients needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Fixed Rates

Explaining SyntheticFi's fixed-rate loans, and how they're a great financing option for long-term or predictable needs.

Joseph Wang

Apr 29, 2025

Box Spread Basics

Floating Rates

Explaining SyntheticFi's floating-rate loans, and how they're a flexible financing option for short-term or variable needs.

Joseph Wang

Apr 29, 2025

Liquidity

Tax

Mortgage

How Debt Can Preserve and Grow Wealth

A primer on how to strategically buy assets like stock & real estate, and borrow against them at low-interest rates, to preserve and build your wealth.

Joseph Wang

Apr 28, 2025

Featured

Case Study

SyntheticFi Supports International Clients When Banks Are Unwilling to Lend

Divergent Capital Asset Management is able to provide securities-backed lending to international clients with SyntheticFi, at lower interest rates.

Joseph Wang

Apr 28, 2025

Tax

Box Spread Basics

Tax Deductibility of Box Spreads

Breaking down the tax deductions for interest loan interest from SyntheticFI loans, and how to report them.

Joseph Wang

Apr 24, 2025

Mortgage

Box Spread Basics

Financing a Home with SyntheticFi

A guide for financing real estate purchases with SyntheticFi to keep a client's portfolio assets while enjoying low interest rates and uncapped tax deductibility on interest.

Joseph Wang

Apr 23, 2025

Featured

Mortgage

Box Spreads: A Better Alternative to Mortgages

Traditional mortgages are expensive and require down payments. Learn about how SyntheticFi's box spread lending strategy offers a better alternative.

Joseph Wang

Apr 22, 2025

Featured

Tax

The Tax Benefits of SyntheticFi Securities-Backed Loans

Learn about the tax advantages of SyntheticFi's lending solutions over traditional securities-backed loans, including universal tax deductibility against capital gains.

Joseph Wang

Apr 22, 2025

Backed by

SyntheticFi LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). SyntheticFi does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Investing carries inherent risks, and investment outcomes are not guaranteed unless stated otherwise. Before adopting any investment strategy, we strongly recommend consulting with a qualified financial advisor and/or tax professional.

All interest rate and tax information is current as of 1/2/2026 and reflects SyntheticFi’s best market estimates. Rates shown are indicative only; SyntheticFi does not guarantee execution at the quoted implied interest rates.

*Rates displayed are illustrative and subject to market changes. Not including SyntheticFi's fees.

†The interest rate and tax deduction savings interactive tool is for illustrative purposes only. Calculations assume interest rate savings equal to 2% of the loan amount and potential tax savings equal to 1% of the loan amount. Actual savings may vary based on market conditions, loan structure, tax circumstances, and individual client eligibility. Savings estimates are based on generalized assumptions and do not constitute tax, legal, or investment advice. Users should consult with their own financial or tax advisors to assess the applicability of any savings in their personal circumstances. This tool does not recommend or favor any specific investment and does not evaluate or compare a universe of alternative lending or investment options. Other financial solutions not analyzed here may offer similar or greater benefits.

‡APR, or the Annual Percentage Rate, disclosed above is calculated in accordance with the federal Truth in Lending Act (Regulation Z) guidelines and reflects the estimated total cost of borrowing, inclusive of the maximum fees charged by SyntheticFi that is subject to discount. This is not a rate guarantee. This APR represents the nominal interest rate annualized over monthly compounding periods and incorporates all mandatory periodic payments and final payoff obligations associated with the loan.

We are committed to full transparency and compliance; this rate enables an apples-to-apples comparison with other financing options by including both interest and applicable service fees in accordance with regulatory standards.

You can check the background of SyntheticFi LLC on the website of the SEC. Please refer to our Form CRS and Firm Brochure for important disclosures.

By using syntheticfi.com, you accept our Terms of Use and Privacy Policy.

Backed by

SyntheticFi LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). SyntheticFi does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Investing carries inherent risks, and investment outcomes are not guaranteed unless stated otherwise. Before adopting any investment strategy, we strongly recommend consulting with a qualified financial advisor and/or tax professional.

All interest rate and tax information is current as of 1/2/2026 and reflects SyntheticFi’s best market estimates. Rates shown are indicative only; SyntheticFi does not guarantee execution at the quoted implied interest rates.

*Rates displayed are illustrative and subject to market changes. Not including SyntheticFi's fees.

†The interest rate and tax deduction savings interactive tool is for illustrative purposes only. Calculations assume interest rate savings equal to 2% of the loan amount and potential tax savings equal to 1% of the loan amount. Actual savings may vary based on market conditions, loan structure, tax circumstances, and individual client eligibility. Savings estimates are based on generalized assumptions and do not constitute tax, legal, or investment advice. Users should consult with their own financial or tax advisors to assess the applicability of any savings in their personal circumstances. This tool does not recommend or favor any specific investment and does not evaluate or compare a universe of alternative lending or investment options. Other financial solutions not analyzed here may offer similar or greater benefits.

‡APR, or the Annual Percentage Rate, disclosed above is calculated in accordance with the federal Truth in Lending Act (Regulation Z) guidelines and reflects the estimated total cost of borrowing, inclusive of the maximum fees charged by SyntheticFi that is subject to discount. This is not a rate guarantee. This APR represents the nominal interest rate annualized over monthly compounding periods and incorporates all mandatory periodic payments and final payoff obligations associated with the loan.

We are committed to full transparency and compliance; this rate enables an apples-to-apples comparison with other financing options by including both interest and applicable service fees in accordance with regulatory standards.

You can check the background of SyntheticFi LLC on the website of the SEC. Please refer to our Form CRS and Firm Brochure for important disclosures.

By using syntheticfi.com, you accept our Terms of Use and Privacy Policy.

SyntheticFi LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). SyntheticFi does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Investing carries inherent risks, and investment outcomes are not guaranteed unless stated otherwise. Before adopting any investment strategy, we strongly recommend consulting with a qualified financial advisor and/or tax professional.

All interest rate and tax information is current as of 1/2/2026 and reflects SyntheticFi’s best market estimates. Rates shown are indicative only; SyntheticFi does not guarantee execution at the quoted implied interest rates.

*Rates displayed are illustrative and subject to market changes. Not including SyntheticFi's fees.

†The interest rate and tax deduction savings interactive tool is for illustrative purposes only. Calculations assume interest rate savings equal to 2% of the loan amount and potential tax savings equal to 1% of the loan amount. Actual savings may vary based on market conditions, loan structure, tax circumstances, and individual client eligibility. Savings estimates are based on generalized assumptions and do not constitute tax, legal, or investment advice. Users should consult with their own financial or tax advisors to assess the applicability of any savings in their personal circumstances. This tool does not recommend or favor any specific investment and does not evaluate or compare a universe of alternative lending or investment options. Other financial solutions not analyzed here may offer similar or greater benefits.

‡APR, or the Annual Percentage Rate, disclosed above is calculated in accordance with the federal Truth in Lending Act (Regulation Z) guidelines and reflects the estimated total cost of borrowing, inclusive of the maximum fees charged by SyntheticFi that is subject to discount. This is not a rate guarantee. This APR represents the nominal interest rate annualized over monthly compounding periods and incorporates all mandatory periodic payments and final payoff obligations associated with the loan.

We are committed to full transparency and compliance; this rate enables an apples-to-apples comparison with other financing options by including both interest and applicable service fees in accordance with regulatory standards.

You can check the background of SyntheticFi LLC on the website of the SEC. Please refer to our Form CRS and Firm Brochure for important disclosures.

By using syntheticfi.com, you accept our Terms of Use and Privacy Policy.

Backed by

SyntheticFi LLC is an investment advisor registered with the U.S. Securities and Exchange Commission (SEC). SyntheticFi does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. Investing carries inherent risks, and investment outcomes are not guaranteed unless stated otherwise. Before adopting any investment strategy, we strongly recommend consulting with a qualified financial advisor and/or tax professional.

All interest rate and tax information is current as of 1/2/2026 and reflects SyntheticFi’s best market estimates. Rates shown are indicative only; SyntheticFi does not guarantee execution at the quoted implied interest rates.

*Rates displayed are illustrative and subject to market changes. Not including SyntheticFi's fees.

†The interest rate and tax deduction savings interactive tool is for illustrative purposes only. Calculations assume interest rate savings equal to 2% of the loan amount and potential tax savings equal to 1% of the loan amount. Actual savings may vary based on market conditions, loan structure, tax circumstances, and individual client eligibility. Savings estimates are based on generalized assumptions and do not constitute tax, legal, or investment advice. Users should consult with their own financial or tax advisors to assess the applicability of any savings in their personal circumstances. This tool does not recommend or favor any specific investment and does not evaluate or compare a universe of alternative lending or investment options. Other financial solutions not analyzed here may offer similar or greater benefits.

‡APR, or the Annual Percentage Rate, disclosed above is calculated in accordance with the federal Truth in Lending Act (Regulation Z) guidelines and reflects the estimated total cost of borrowing, inclusive of the maximum fees charged by SyntheticFi that is subject to discount. This is not a rate guarantee. This APR represents the nominal interest rate annualized over monthly compounding periods and incorporates all mandatory periodic payments and final payoff obligations associated with the loan.

We are committed to full transparency and compliance; this rate enables an apples-to-apples comparison with other financing options by including both interest and applicable service fees in accordance with regulatory standards.

You can check the background of SyntheticFi LLC on the website of the SEC. Please refer to our Form CRS and Firm Brochure for important disclosures.

By using syntheticfi.com, you accept our Terms of Use and Privacy Policy.