Back

Featured

Liquidity

5 mins

How to Access Liquidity Without Selling Your Investments

Learn what a securities-backed loan (SBL/SBLOC) is, how borrowing against a portfolio works, allowed use cases, key considerations, and when you should consider a SBL over selling stock.

Joseph Wang

Feb 10, 2026

Key Takeaways

Securities-backed loans (a.k.a. SBLs, SBLOCs) allow you to access liquidity without selling by borrowing directly against your investments.

Why use SBLs: securities-backed borrowing allows your portfolio to continue to grow without interruption and avoid triggering a large taxable event.

When you should use SBLs: use SBLs when you have short-term or long-term cash or financing needs. Depending on the type of SBL, securities-backed loans can be either non-purpose loans or may be used for any purpose — real estate bridging or purchases, vehicle loans, large tax bills, business investments, and more.

Who benefits most from SBLs: those with highly appreciated stock, living in high-tax jurisdictions, and investors who expect continued portfolio growth.

Advanced SBL structures: box spread loans are a form of securities-backed borrowing that may provide greater flexibility than traditional SBLs, including unrestricted use of proceeds, market-based wholesale interest rates, fixed-rate options, and tax-deductible interest.

What’s the first source of liquidity you think of when you’re in need of cash? Your savings and investment accounts. Here’s why that is both the right and wrong solution.

The Wrong Way to Fund Liquidity Needs: Selling Stock

When most people think of using their investment accounts to fund liquidity needs, they’re thinking of selling stock. Selling assets as a source of liquidity has some major downsides:

Triggers a large capital gains tax bill

Lose out on the future value of growth

Your assets could have been working twice as hard for you

The Better Way to Fund Liquidity Needs: Securities-Backed Loans (SBLs)

Robert Kiyosaki, author of Rich Dad, Poor Dad, famously said “Don’t work for money. Make money work for you.” When you’re selling assets to fund your life’s financing needs, you’re losing out on “workers.”

Here’s how to actually use your investment account as a source of liquidity: keep all your assets invested, and borrow against your investments instead.

That’s where securities-backed borrowing comes in. Charles Schwab describes securities-backed borrowing as a way to use your investment portfolio’s securities and “borrow against their value to accomplish goals without upending your wealth management plans.” Now your assets are working twice as hard for you.

Types of Securities-Backed Loans and Common Use Cases

There are 4 main types of securities-backed loans:

Securities-backed line of credit (SBLOC)

Pledged-asset line (PAL)

Margin loan

Box spread loans can be a great fit for many investors and high-net worth clients.

Box spread loans come with the benefit of having no restrictions on use of proceeds, compared to SBLOCs, PALs, and margin loans which all have some form of restrictions on what the loan funds can be used for. In addition, box spread loans typically offer the most competitive rates and come with unique tax benefits, where interest may be treated as capital loss under the IRS 60/40 Rule.

For example, Bloomberg featured how box spread loans allowed SyntheticFi’s co-founder to lock in a 1.6% mortgage in 2021, back when average mortgage rates were around 3.0%, and with no upper limit on interest deductions unlike a traditional mortgage.

Other common use cases beyond real estate purchases include but are not limited to:

auto loan purchases

bridge loans

business financing

arbitrage investing

lifestyle purchases

Why Choose Securities-Backed Loans Over Selling Stock

Securities-backed loans make the most sense when the cost of liquidating exceeds the cost of borrowing.

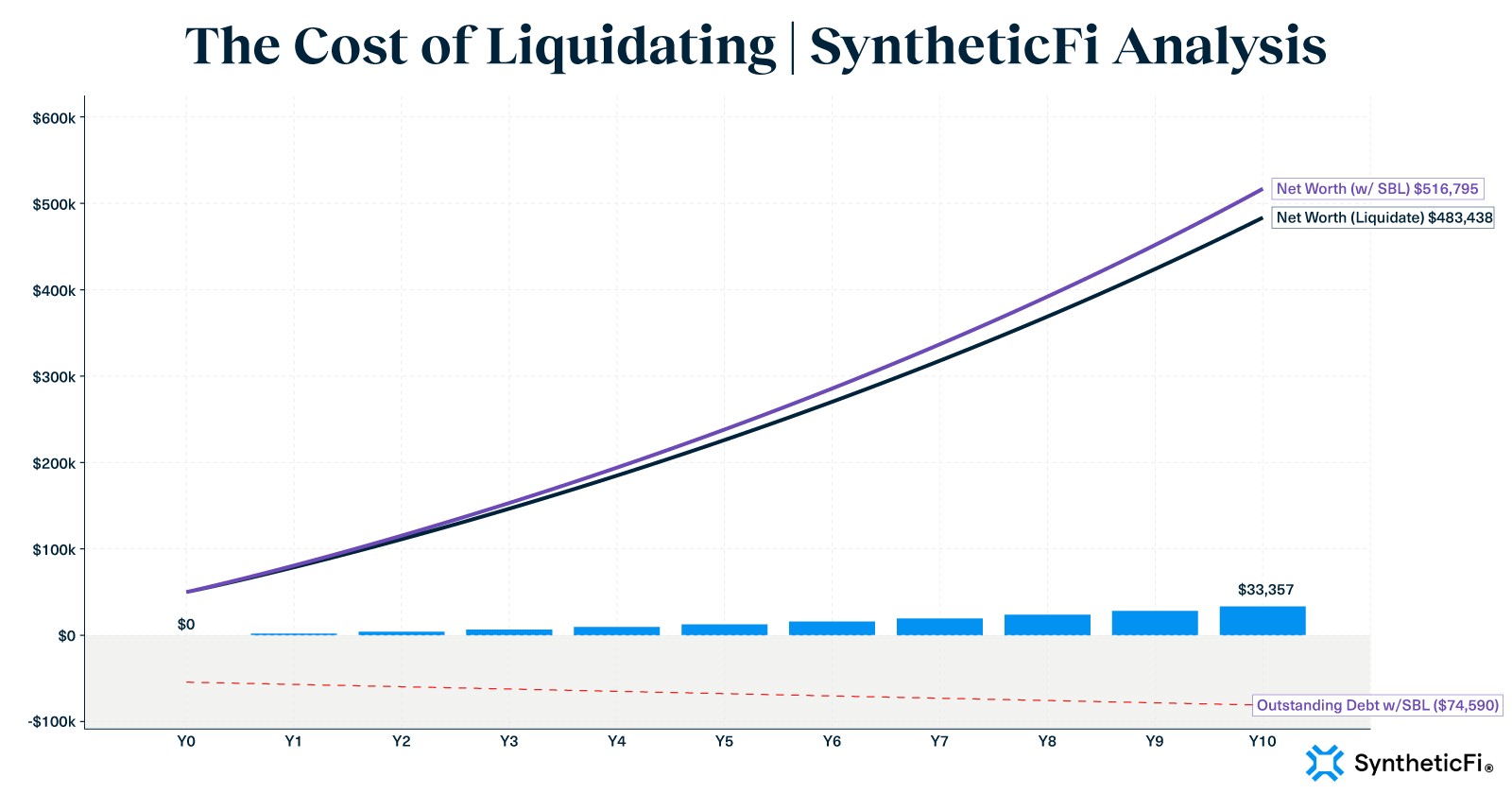

For example, say you’ve saved up $100,000 in your portfolio, but need to finance a $50,000 project today. You have two main options: borrow, or liquidate. The graph below compares the impact on net worth when using each of these options.

When you sell $50,000 in stock, and without even considering the tax impacts, the cost of liquidating exceeds the cost of borrowing in excess of $100,000 over a 10-year horizon; adjusted for outstanding debt, this results in approximately a $33,357 difference in net worth, or a little over 1/3 of the initial value of your portfolio (assuming an average annual return of 8% and a 4% compound interest rate).

* Assumes portfolio growth at 8% annually, 4% SBL interest rate (compounded daily), and monthly deposits of $2,000 into the investment account. Excludes tax considerations.

This is the silent cost of liquidating: when you sell off half of your portfolio today, you forfeit ~33.4% of your starting portfolio over 10 years. This is assuming zero tax consequences; the impact becomes even greater once tax is factored into the equation.

As seen in the exhibit below, this pattern holds true regardless of the starting portfolio value. Even if your borrowing rate were 2% higher, at 6%, you'd still be forfeiting ~16.8% of your starting portfolio over 10 years.

Starting Portfolio Balance | Liquidity Need | Net Worth After 10 Years When Using SBLs | Net Worth After 10 Years When Selling Stock | The Cost of Liquidating, in $ | The Cost of Liquidating, as a % of Starting Portfolio |

|---|---|---|---|---|---|

$100,000 | $50,000 | $516,795 | $483,438 | $33,357 | 33.36% |

$500,000 | $250,000 | $1,082,006 | $915,223 | $166,783 | 33.36% |

$1,000,000 | $500,000 | $1,788,521 | $1,454,954 | $333,567 | 33.36% |

$5,000,000 | $2,500,000 | $7,440,638 | $5,772,804 | $1,667,834 | 33.36% |

$10,000,000 | $5,000,000 | $14,505,784 | $11,170,117 | $3,335,667 | 33.36% |

* Assumes portfolio growth at 8% annually, 4% SBL interest rate (compounded daily), and monthly deposits of $2,000 into the investment account. Excludes tax considerations.

Key Risks and Considerations

Securities-backed loans aren’t for everyone. To be eligible, you must have a taxable brokerage account at a custodian that supports the use of your securities as collateral. The types and specific securities you own may also impact your borrowing eligibility, and these requirements vary depending on your banking institution.

Further, if the value of your collateral drops below custodian-determined minimum maintenance requirements, you may be forced to meet the maintenance requirement, either by selling your assets to pay down your loan size, or by adding more assets to increase the value of your collateral. At SyntheticFi, we recommend working with your financial advisor to determine how much you can safely borrow.

Rule of Thumb: When You Should Use SBLs

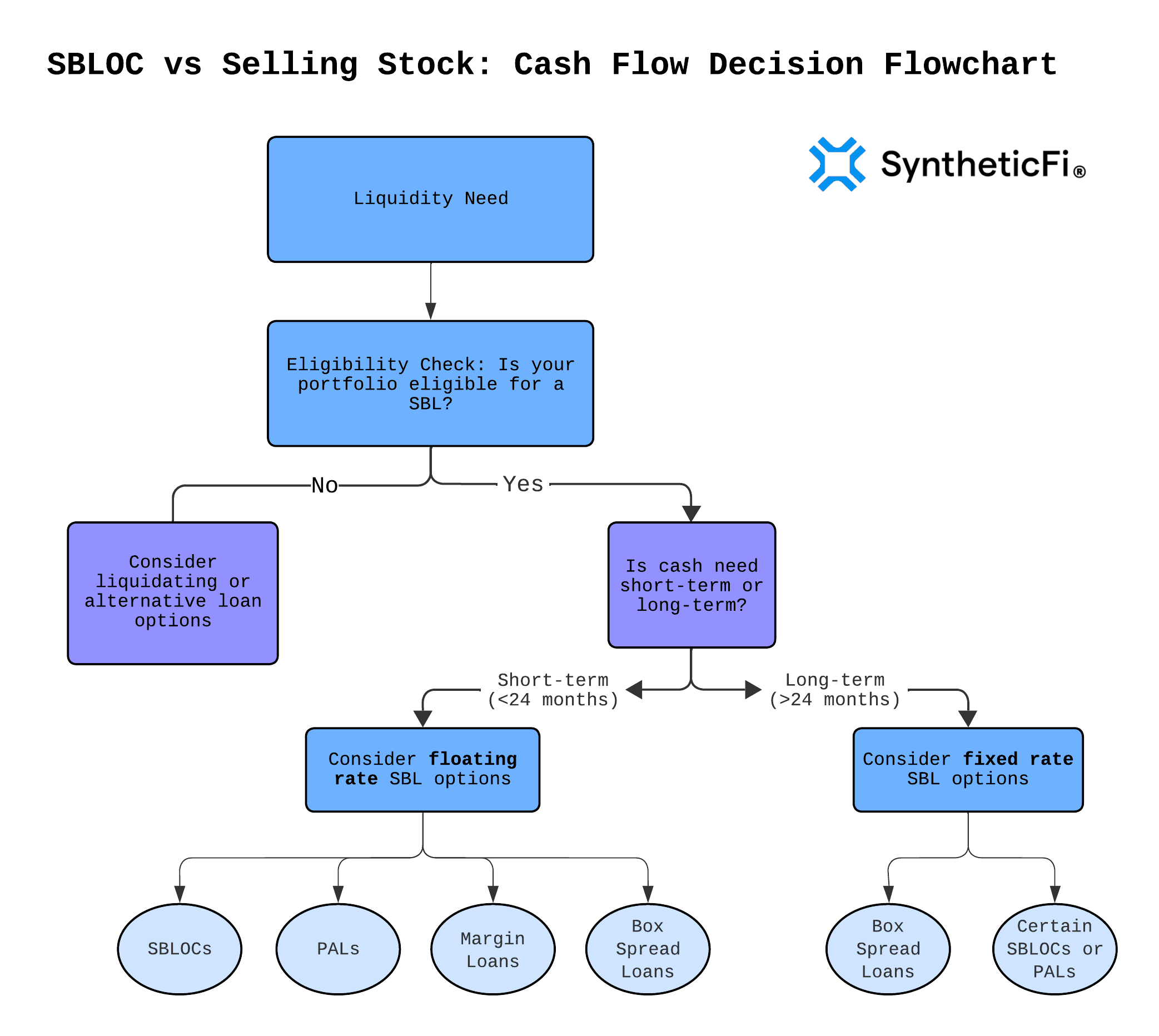

Here’s how to decide when to use securities-backed loans versus liquidating, and what type of SBL to use for your cash flow needs:

Check if your portfolio is eligible for a SBL.

If not eligible, consider liquidating or an alternative loan option.

If eligible, next determine if your financing need is over a short-term time horizon (typically less than 24 months) or long-term (more than 24 months).

If short-term, then floating rate SBLs may be the best fit for you. This can be supported by all 4 major types of SBLs.

If long-term, then fixed rate SBLs may be the best fit for you. This can only be supported by box spread loans and certain financial institutions’ SBLOC or PAL programs.

Bottom Line

Securities-backed loans can provide liquidity while staying invested, but they involve risks and aren't necessarily right for everyone.

If you think a securities-backed loan may be a fit for you, start a conversation with your financial advisor. If you're exploring a box spread loan, ask your advisor to reach out to SyntheticFi.