Back

Box Spread Basics

9 mins

Floating Rates

Explaining SyntheticFi's floating-rate loans, and how they're a flexible financing option for short-term or variable needs.

Joseph Wang

Apr 29, 2025

Key Takeaways

Flexible Financing: SyntheticFi’s floating-rate loans track SOFR (plus a 0.2% spread) and reset monthly, while giving borrowers a true line of credit: you can draw and repay on your schedule with no prepayment penalties or fixed repayment deadlines.

Ideal for Short-Term or Variable Needs: Because they work like an open credit facility, floating-rate loans excel as bridge financing—such as closing on a new home before selling your old one, flipping property, covering unexpected bills, or meeting capital calls—without locking you into a fixed term.

Versatile Use Cases: Beyond bridge loans, you can use floating-rate financing to diversify a concentrated portfolio without selling (avoiding capital gains), take margin-style positions in other securities, consolidate high-interest debts into a single lower-cost facility, or fund lifestyle purchases with flexible repayment.

Balance Benefits Against Risks: Floating-rate loans offer liquidity and potential cost savings, but come with uncertain monthly interest costs. So they’re best for borrowers with a cash-flow buffer or time horizon that's relatively short or flexible.

What is a Floating-Rate Loan?

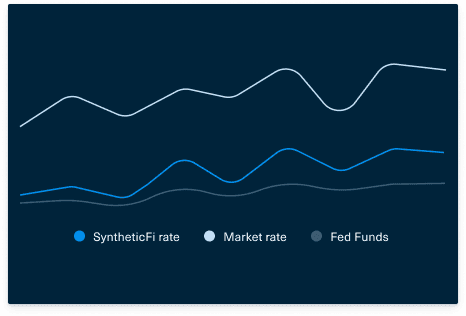

A floating-rate loan, sometimes called a variable-rate loan, is a loan where the interest rate adjusts based on market conditions. SyntheticFi's floating-rate loans are benchmarked against SOFR—a widely used base interest rate—with an extra 0.2%. This means your interest rate updates monthly, reflecting modifications in the base interest rate, SOFR, which depends on market conditions. Your initial interest rate quote may be 4% when you take out the loan, but the next month, it could be 3.75%, if the benchmark rate drops by 0.25%.

A nice feature of our floating-rate loans is that they are structured like an open line of credit. This gives you a lot of flexibility:

You can borrow more or pay down the loan whenever you like (no prepayment fees or late payment penalties).

All unpaid interest can accrue without a fixed repayment deadline.

The loan can stay active indefinitely, provided your portfolio collateral meets our maintenance standards.

Differences Between Floating-Rate Loans and Fixed-Rate Loans

With a fixed rate-loan, you lock in a steady interest rate for the entire term, and at the end, you repay both the combined principal and interest in full. Floating rate loans, on the other hand, support greater flexibility. While the loan is outstanding, if interest rates rise, your interest payments increase; conversely, if rates drop, you save money. This balance of opportunity and uncertainty is what makes them unique—and valuable in the right context.

What about differences in interest rates? Technically speaking, SyntheticFi's floating-rate and fixed-rate loans are mathematically equivalent. When rate cuts by the Fed are expected, a common misconception is that borrowing with floating rates is a better choice, even if the initial rates are higher than fixed rates. However, markets tend to be efficient in this respect, pricing longer-term rate cuts into the current interest prices. Therefore, if expectations about the market turn out to be accurate, then the borrowing cost between floating and fixed rate loans becomes roughly equal. To learn more about how these interest rates are determined, read our article about how SyntheticFi loans work.

(If you're a financial advisor looking for more information about deciding between floating and fixed rates for your client, refer to this article.)

When To Choose Floating-Rates

This option is great when you need to borrow with repayment flexibility and/or variable liquidity needs, because floating-rate loans function like a line of credit, allowing you to draw funds as needed and repay them whenever you choose. Here are some common scenarios where you might choose to borrow with floating rates:

To Bridge A Short-Term Financing Gap; aka Bridge Loans

The temporary nature of bridge financing often means you can't commit to an exact repayment timeline. This aligns well with the flexible terms of floating-rate loans.

Buying real estate is one of the most common uses of bridge loans. When you're looking to buy or build a new property, you may need temporary funds before you receive proceeds from selling an existing property. The need to borrow may already be part of your plan or it may be prompted by a sale that falls through, or a closing that is delayed.

Let's say Tony is looking to buy a new home in Menlo Park, priced at $2MM. At the same time, he's posted his existing home for sale, at a ticket price of $1MM. Tony was hoping to sell his current home before closing the deal for the new home, so he would have the cash he needed for the $400K down payment on the new mortgage. Tony's real estate agent had a buyer lined up for his current home, but they backed out at the last minute, and now Tony is 1 week away from the closing deadline for the new home.

Fortunately, Tony's worked at Apple for the last 7 years, and through a combination of employer stock grants and wise investments, he's grown his portfolio to $3MM. As a SyntheticFi client, he can quickly borrow the $400K against his assets with a floating interest rate of 4%. This allows Tony to close on the new house while he waits for a buyer for his old home —without the pressure to meet any repayment deadline. In 3 months, if he manages to sell his vacant property, he can pay back the $400K principal and ~$4K in interest, all while keeping his investment portfolio intact.

Other uses of SyntheticFi's loans for bridge financing include purchasing and renovating properties for reselling (house flipping), meeting urgent capital calls and repaying when distributions are made, or covering large tax bills and repaying when cash flows allow—these are all cases that benefit from freedom of repayment.

When there's some certainty about the repayment timeline, you can take advantage of fixed-rate terms for a period of time, and then refinance with a floating-rate loan, e.g. if Tony knows he'll need at least 6 months before he can find a buyer, he can start with a fixed-rate loan with a 6-month term and then refinance with a floating-rate loan afterwards.

To Diversify My Concentrated Portfolio

Portfolios that are concentrated in one or a few assets require a gradual and dynamic process of rebalancing. This is common if you're a corporate employee compensated with stock. Over your tenure, you may have amassed concentrated positions in your company stock from regular grants and vesting. Instead of selling some of that stock, which likely has a low cost basis which would make you liable for significant capital gains taxes, you can choose to diversify your investments with the help of borrowed funds. When your portfolio stabilizes after making your adjustments, you can use any cash flow to pay down the loan.

Given floating-rate loans are structured as lines of credit, you can draw and repay as needed to achieve your desired diversification, avoiding the rigidity of fixed-rate terms.

Sarah, a senior engineer at a tech firm, has accumulated $2MM in company stock over 10 years through stock grants. Her portfolio is heavily concentrated, with 80% in her employer’s stock, exposing her to significant risk if the company’s stock price drops. To diversify, Sarah wants to invest in a mix of ETFs without selling her stock outright, as this would trigger a large tax bill.

So Sarah secures a floating-rate loan against her portfolio through SyntheticFi, borrowing $500K at a rate of 4%. She uses the funds to purchase broad-market index funds, reducing her portfolio’s concentration. Over the next year, as her new investments distribute dividends and her company stock vests further, she periodically draws small amounts from the loan to continue rebalancing and repays portions of the principal and interest. A well-diversified portfolio yields 7% annually (based on historical stock market performance), enough to offset the 4% interest and more, while stabilizing her wealth. Sarah also uses cash bonuses from her employment to pay down the loan.

The flexibility of the floating-rate loan allows Sarah to diversify at her own pace while managing tax implications and borrowing costs.

To Invest in Other Securities; aka Margin Loan

As the previous example shows, you can take out a loan against your securities to purchase additional securities. However, your objective does not have to be diversification. You can gain leveraged exposure to follow a different investing strategy to try and maximize your returns. You would trade-off against payment certainty, but you expect the gains from your leveraged investments to cover interest and principal. The level of risk involved here is compatible with a floating-rate borrowing strategy, where funds can be flexibly accessed and repaid.

Alex holds a $1.5MM portfolio of blue-chip stocks. He identifies an opportunity to invest in a promising tech stock that he believes will outperform the market, but he can't be sure when the stock will achieve the target performance. To amplify his returns, Alex uses a SyntheticFi floating-rate loan to borrow $300K at a 4% interest rate against his portfolio. He invests the borrowed funds into the stock.

Over the next year and half, the stock generates a 12% return, significantly outpacing the loan’s interest cost. Alex’s $300K investment grows to $336K, yielding a $36K profit before interest. The loan’s interest for the period is approximately $18K, leaving Alex with a net gain of $18K.

Alex decides to pay the interest from dividends he's received but he expects the tech company to continue to perform, so Alex draws an additional $182K in funds from the loan to invest further. After another year passes, the stock generates a 10% return, growing his investment from $500K to $550K. The interest accrued is only $20K, so Alex's net return is $30K over the last year.

Across the two and half years, Alex's profits from investing with debt is $68K. Going forward, Alex can repay portions of the principal and interest when he receives dividends or sells other assets. The floating-rate loan’s flexibility allows him to adjust his borrowing and repayments based on market opportunities and investment performance, optimizing his leveraged strategy.

To Consolidate Other Outstanding Debt Obligations (business loans, HELOCs, car loans, etc.)

Floating-rate loans can be an effective tool for consolidating multiple debts into a single, more manageable loan. They can help you pay off credit card balances, personal loans, or other debts with higher interest rates, potentially reducing your overall borrowing costs. The flexibility afforded by floating-rates is particularly useful when you have variable cash flow or anticipate future income to pay down the loan.

James, a company executive, has accumulated $1MM in debt from various sources: $600K in high-interest bridge financing for a real estate venture at 12% and a $400 personal loan at 9% used for a boat purchase. The steep interest rates and fragmented payment schedules are straining his cash flow, diverting funds from new investment opportunities. James’s investment portfolio, valued at $5MM, consists of diversified equities and private fund interests.

To streamline his finances, James secures a floating-rate loan through SyntheticFi, borrowing $1MM at a 4% interest rate. He uses the funds to pay off the bridge and personal loan in full, consolidating his high-interest debt into a single, lower-cost loan. The floating-rate loan’s flexibility allows James to make substantial principal payments when he receives carried interest distributions from his private equity deals, while making smaller payments during periods of lower liquidity. He also draws an additional $250K from the loan to seize a time-sensitive investment opportunity in a new fund, repaying it after liquidating a portion of his equity holdings.

By consolidating his debt, James saves approximately $100K annually in interest compared to his previous debt structure, freeing up capital for further investments while maintaining his portfolio’s growth trajectory.

To Fund Lifestyle Purchases

Because a floating-rate loan can serve as a line of credit, it's functionally similar to a credit card. Like a personal credit card, you can spend the funds on non-essential items and experiences, e.g. a vehicle purchase or luxury vacation.

What to Watch Out For

While floating rate loans have clear upsides, they’re not without risks:

Rising Rates: If market rates climb, your interest costs will too, which could stretch your budget. That's why they're more appropriate for short-term borrowing needs or situations where you have a sufficient cash flow buffer.

Unpredictable Costs: With rates vulnerable to changes every month, it becomes harder to budget and plan your finances over longer time horizons.

Before jumping in, consider your risk tolerance, financial plans, and how comfortable you are with change.

Wrapping Up

SyntheticFi’s floating rate loans offer a versatile, potentially cost-saving option for borrowers who need short-term cash, have unpredictable income, or want to capitalize on market shifts. That said, it’s all about balance. Weigh the flexibility and liquidity advantages against the risks, and think about what fits your goals. For a deeper dive into your options, schedule a consultation with one of our advisors. We’re here to help you find the borrowing strategy that works best for you.